Ready to Get Started?

Ship your cargo in a transparent and cost-effective way with us, a Haulage expert from Port Klang.

Get Started

To begin, let’s establish what a Bill of Lading (BL) is before discussing measures to take if it becomes lost, stolen, or damaged.

What is Bill of Lading?

Bill of Lading (BL) is a shipping document that is issued once the vessel departs from the port of lading, serving as a type of air ticket or boarding pass. Notably, the BL issue date corresponds to the vessel departure date. Therefore, the marine insurance authority will recognize it since it is also a legal document.

Bill of Lading (BL) is a shipping document that is issued once the vessel departs from the port of lading, serving as a type of air ticket or boarding pass. Notably, the BL issue date corresponds to the vessel departure date. Therefore, the marine insurance authority will recognize it since it is also a legal document.

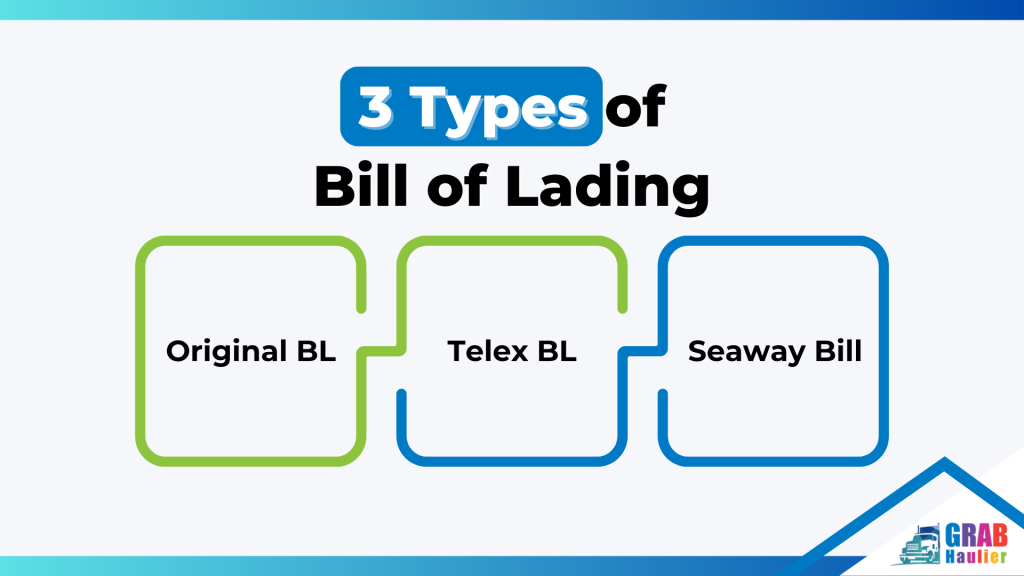

3 types of Bill Lading (BL)

Original Bill of Lading

The first BL is the original BL; normally the shipper will ask for the original BL when the consignee has not made any payment. The consignee needs to return 1 copy of the original BL to the shipping line for the exchange of the Delivery Order.

Telex Bill of Lading

The second BL is Telex BL. When the consignee has made the payment, telex BL will be used and original BL is not needed. The shipper can release the cargo. Do note that telex charges range from RM180 to RM250, so it depends on the liner tariff.

Seaway Bill

Moreover, a Seaway Bill is issued when the consignee has made the payment. There are no charges applied, and you can save on telex fee and the international courier charge. Like Telex BL, the shipper can release the cargo without the original BL.

Key Takeaways

In short, Telex BL and Seaway bills are preferred in the event of a pandemic or natural disasters, such as floods or fires. If you lose the BL in such an event, like the Sri Muda flood, having purchased insurance will protect you even if the BL is lost. However, many people did not opt for insurance as they wanted to save on shipping costs. Consequently, this can lead to unwanted hassle when unpredictable incidents occur.

What to do if BL is lost?

If your Bill of Lading (BL) is lost, it’s crucial to act quickly and follow these three steps advised by major shipping lines:

1. File a detailed police report about the incident

1. File a detailed police report about the incident

In case of a lost Bill of Lading (BL), the first step is to file a detailed police report about the incident. Hence, this report will be important in case there are any legal issues that arise from the loss of the BL.

2. Provide a bank guarantee for the cargo value and customs form when requested by the liner

For instance, if the customs form declares RM100K, the liner normally will request a bank guarantee ranging from RM100k to RM200k. Do note that the liner will hold the bank guarantee for up to 1 year or more. Thus, always negotiate with shipping lines on the amount of the bank guarantee and the holding period.

3. Obtain a Letter of Indemnity (LOI) from the shipper and consignee

A Letter of Indemnity (LOI) is a legal document that serves as a guarantee against any claims that may arise due to the loss of the BL. Typically, the shipping line will provide the format for the LOI.

Where can I get more information about Haulage?

For information about Haulage in Port Klang, look no further than Grab Haulier. We encourage you to follow us on Facebook and Grab Haulier website to stay up-to-date on informative and useful content in the future. Don’t forget to give us a “Like” and share with your friends.